reit dividend tax rate 2021

The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. These next two tables present the tax rates assessed on ordinary or non-qualified dividends in.

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Turkey reduces withholding tax rate on dividend distributions to 10.

. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives. Preferred shares in addition to five.

The SP 500 was up 27 with REITs as one of its top-performing sectors 462. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. For 2021 these rates remain unchanged from 2020.

Certain classes of shareholder are eligible to receive gross PID dividends. 25 May 2021. However the income thresholds for each bracket have been adjusted to account for inflation.

915 tax rate if shareholder owns more than 50 of the REITs voting stock. The tax rate on nonqualified dividends is the same as your regular income tax bracket. 2021 Ordinary Dividend Per Share.

This REIT has supported three and five-year annual dividend growth rates of 18 and 19 respectively while. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. 16 hours agoAMTs revenues rose 16 in 2021 adjusted FFO increased 15 and dividends grew 15.

See Why More Than 170000 Investors Have Invested More Than 1 Billion With Fundrise. Short term capital gains and long-term gains on collectibles 1200. Major indexes ended 2021 with one of their best years on record.

830 tax rate if shareholder owns 25 or more of the REITs stock. 2021 Return of Capital Per Share. Income tax rate applies.

Tax year 2021 File in 2022 Personal income and fiduciary income Long term capital gains Dividends interest wages other income. And the shareholders are subjected to tax on the dividends irrespective of the rate of tax paid by the company. US Distributions MLPs 396 Withheld Foreign Tax Credit can be claimed.

August 2021 Common Stock Dividend Information Month Dividend Holder of Record Date Payment DateAugust 2021 010 August 16 2021 August 27 2021 Certain Tax Matters ARMOUR has elected to be taxed. The 15th day of the 4th month for fiscal year filings. 4936 the Decision was published in the Official Gazette.

First a capital gains qualifying event occurs if the REIT sells property that it has owned and managed. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. On 22 December 2021 Turkeys Presidential Decision No.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. 15 Withheld Foreign Tax Credit can be claimed. Taxpayers may also generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through Dec.

Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. 396 Withheld No Foreign Tax. As of July 2021 its annual dividend was 228 for a yield of 586.

REITs and Capital Gains Taxes. Type of Tax. These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. There are two instances when your REIT will encounter capital gains taxes. A ReitInvIT can therefore effectively give investors a.

15 for REIT under certain conditions. 15 Withheld No Foreign Tax Credit. Income tax rate applies.

710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. STAG Industrial STAG STAG Industrial STAG invests in industrial-use. 15 Withheld No Foreign Tax Credit.

Turkey reduces withholding tax rate on dividend distributions to 10. The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 12 January 2022 Recipients Country Alphabetical Order Maximum Tax Rates Remarks Dividends Interest Redemption Australia 1015 1 0 2 10 20 2 10 1. The Decision reduces the general withholding tax WHT rate on dividend distributions from.

PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder. On or before April 15 for calendar year filings.

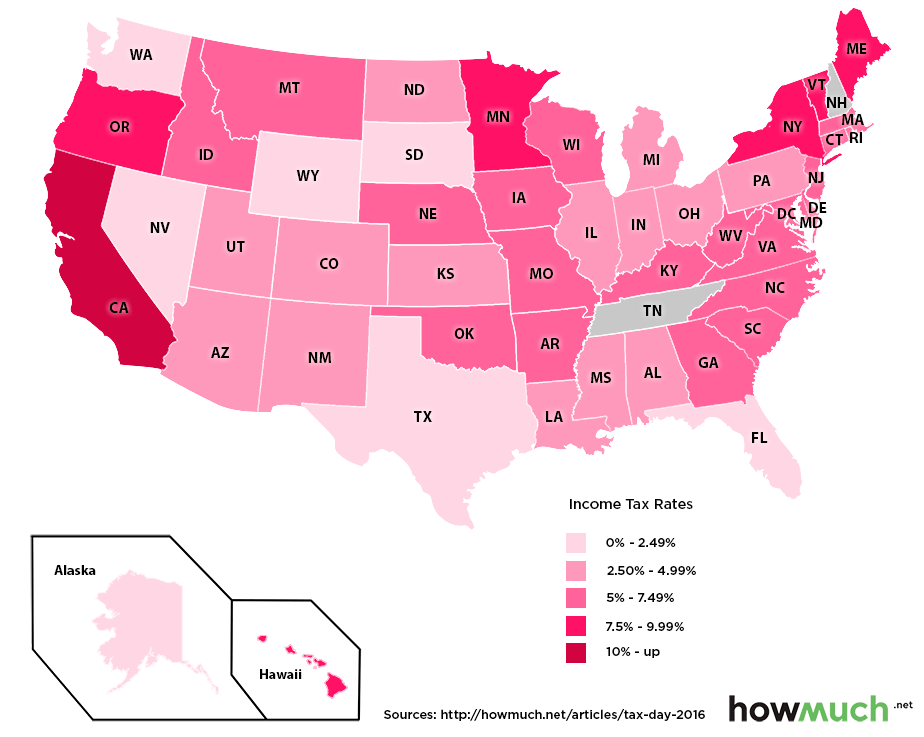

Which U S States Have The Lowest Income Taxes

Reit Investing Checklist In 2021 Investing Value Investing Stock Market

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

5 Safe And Cheap Dividend Stocks To Invest In Seeking Alpha In 2022 Dividend Stocks Investing Investing In Stocks

Secret Tax Hacks Money Management Investment Quotes Real Estate Investor

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Dividend Tax 2021 22 Explained Raisin Uk

Long Term Investments Investing Finance Investing Value Investing

Sec 199a And Subchapter M Rics Vs Reits

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Solved Final Tax Rates Write The Final Tax Rate Applicable For Each Income If It Is Exempt Write Ex If It Is Subject To Other Income Tax Schemes Course Hero

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends